See the Whole Picture, Not Just the Pieces

Private equity firms need more than snapshots of individual companies – they need visibility across the portfolio. Drawbridge’s Portfolio Analytics gives sponsors the intelligence to benchmark, monitor and reduce cyber risk portfolio-wide, ensuring stronger governance, smoother exits and greater investor confidence.

Because Portfolio Risk Is Your Risk

Every portfolio company adds new exposure. Without consistent oversight, hidden vulnerabilities can drag down valuations and delay deals.

Drawbridge helps you:

Establish consistent baseline controls across all portfolio companies

Identify the riskiest entities and prioritize remediation

Provide LPs and boards with proof of strong portfolio governance

Protect valuation at exit by improving cyber maturity across the portfolio

Portfolio-Wide Oversight Made Simple

Our Cyber Risk Intelligence platform provides real-time line-of-sight into every company in your portfolio.

Baseline Assessments

Score each company consistently against peers and standards.

Peer Benchmarking

Compare portfolio companies to industry data across 1,200+ firms.

Remediation Tracking

Monitor fixes in progress and ensure improvements stick.

Portfolio Reporting

Deliver clean, digestible updates to LPs and boards.

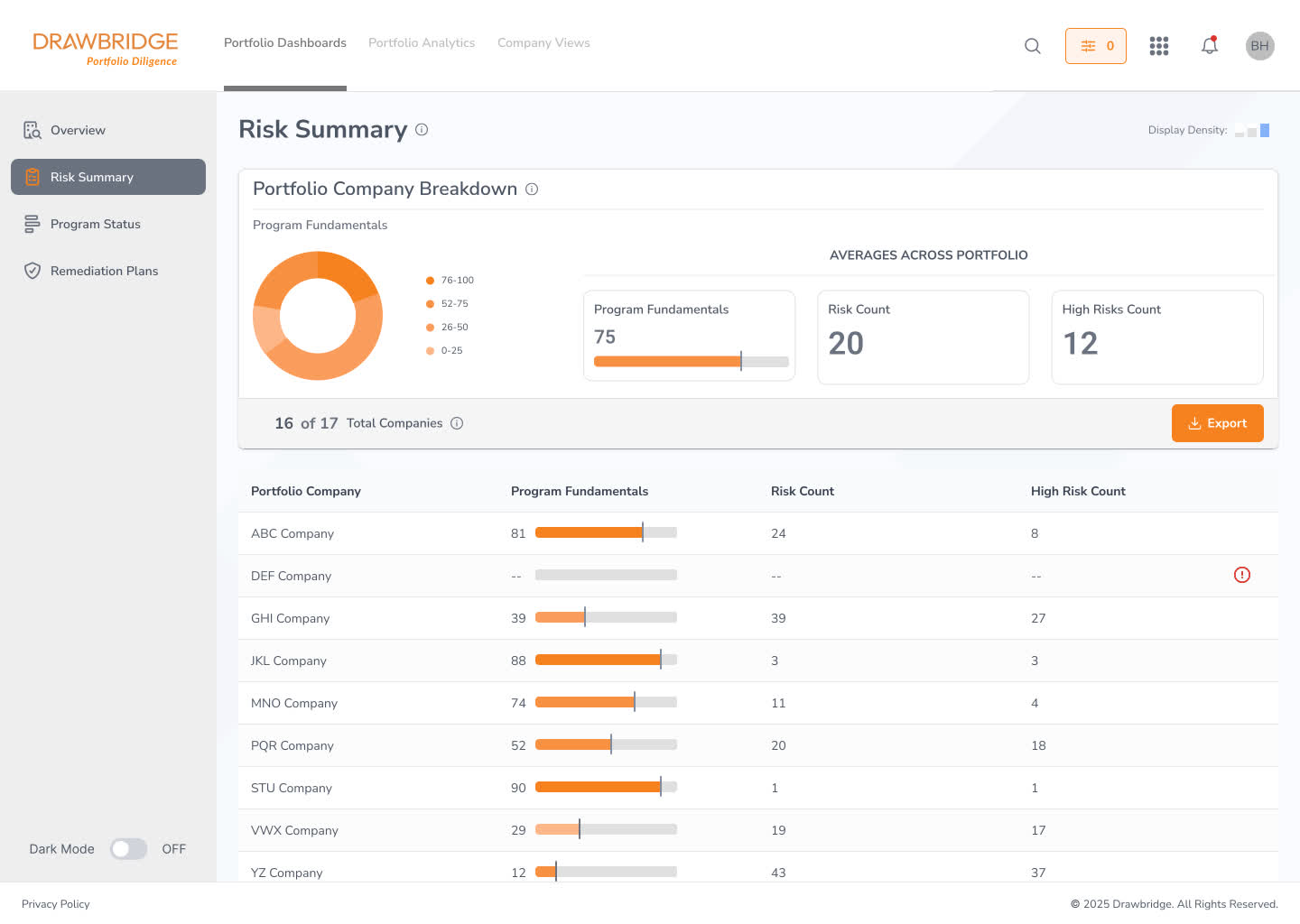

Identify which portfolio companies carry the greatest cyber risk at a glance.

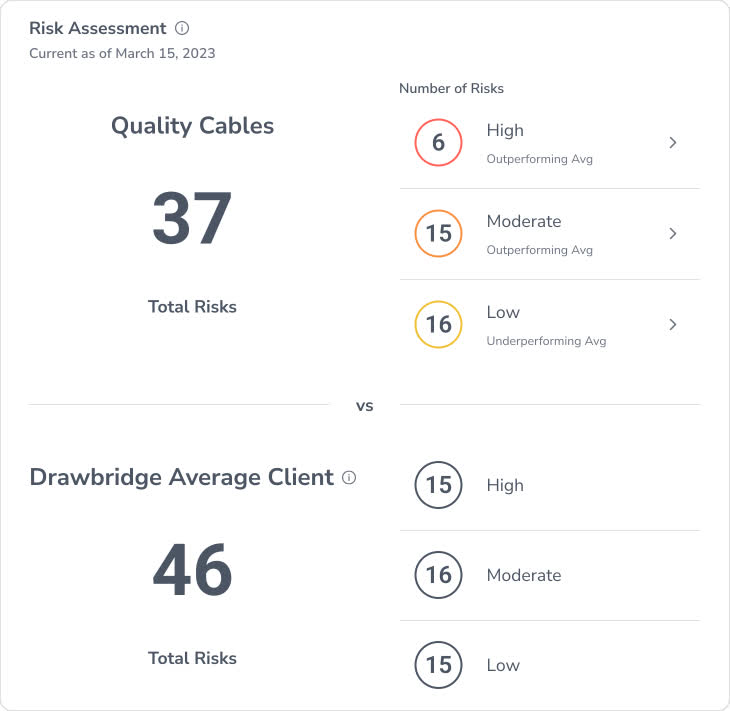

See how each company – and your portfolio overall – compares against peers.

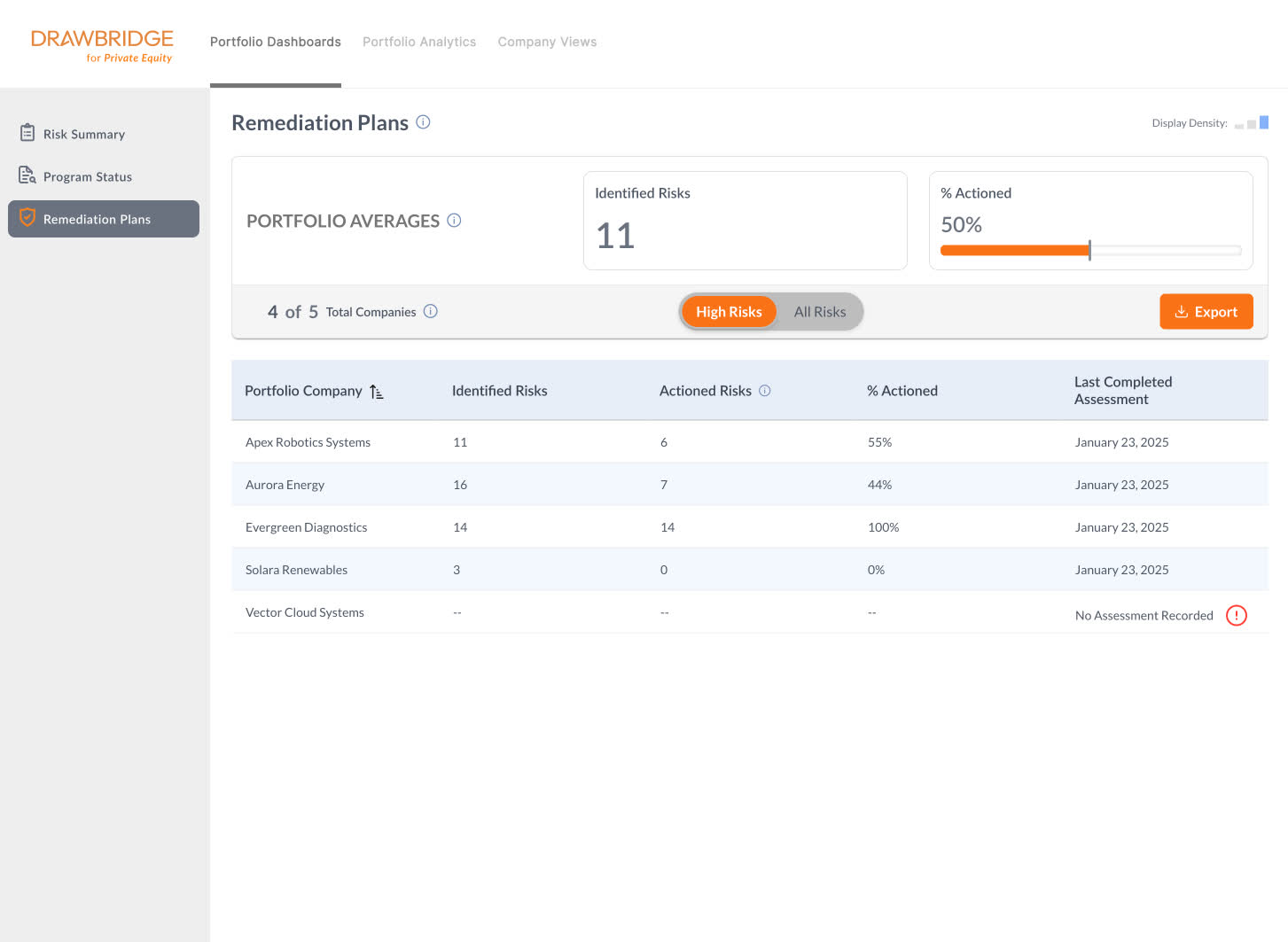

Track portfolio remediation progress in real time.

Why Sponsors Trust Drawbridge for Portfolio Analytics

We provide the visibility, benchmarking and credibility PE firms need to protect value across every portfolio company.

Purpose-Built for PE

Designed for sponsors managing multiple portfolio companies.

Investor Recognition

Drawbridge reports and dashboards are trusted in fundraising and reviews.

Data Depth

Powered by proprietary data from 1,200+ firms and 5,000+ vendors.

Real-Time Oversight

Always-on monitoring, no blind spots.

Stronger Portfolios, Smoother Exits

Helping sponsors protect capital and inspire LP confidence.

Private equity sponsors rely on Drawbridge to secure value across portfolios – from early-stage monitoring to exit planning. Firms that embed Drawbridge’s oversight reduce risk exposure, streamline compliance and maximize valuation.