Protect Your Firm from Third-Party Weak Links

Your cybersecurity is only as strong as the vendors you rely on. From fund administrators and custodians to cloud providers, third-party systems create hidden risks that can expose your firm to costly breaches and regulatory scrutiny. Drawbridge Vendor Risk Assessments deliver independent, hands-on evaluations of your critical providers – so you can spot weaknesses before they impact your firm and prove your diligence to investors and regulators.

Supply Chain Risk Is Fund Risk

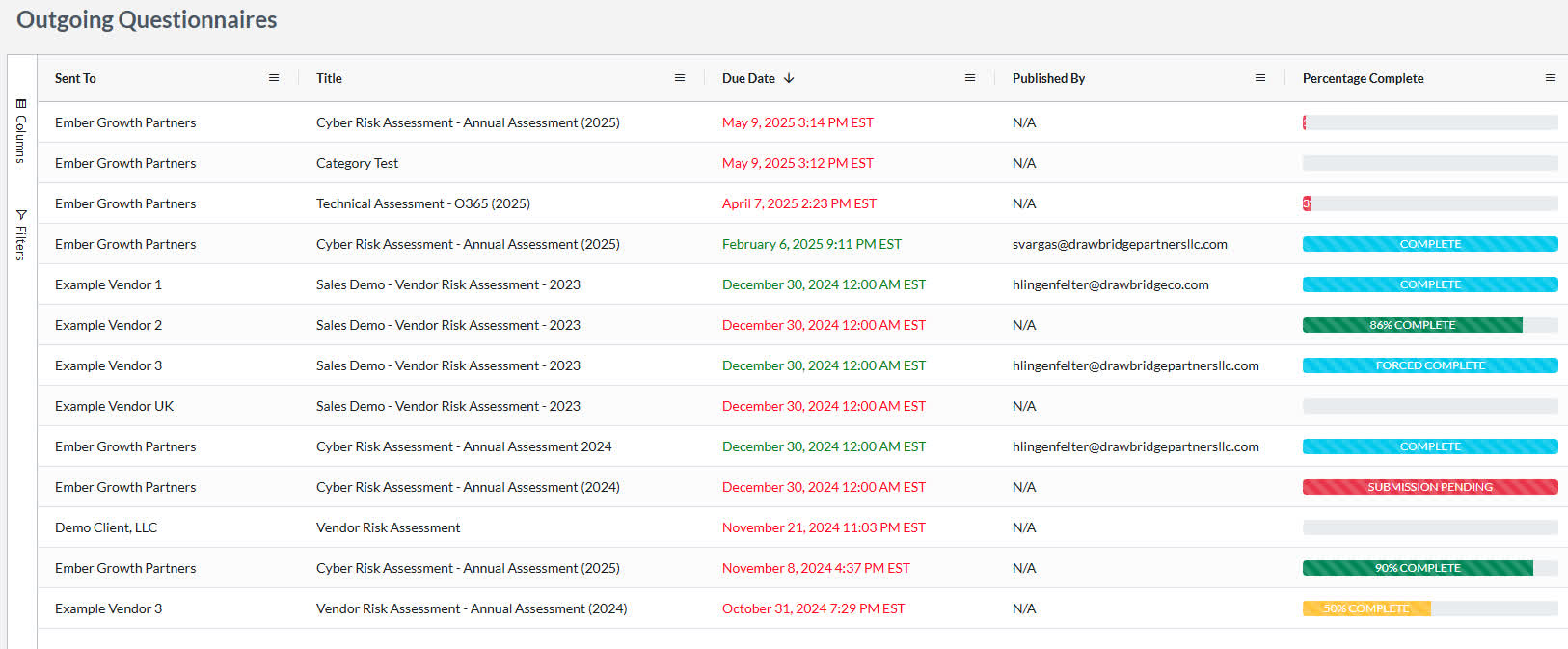

Regulators, investors and boards expect firms to take vendor oversight seriously. Passive scores and generic ratings aren’t enough. Drawbridge Vendor Risk Assessments provide qualitative, in-depth analysis that goes beyond surface scans.

We help you:

Identify vulnerabilities in your critical third-party providers

Support compliance with SEC, FCA and DORA requirements for third-party risk management

Provide evidence of due diligence during audits and ODD reviews

Strengthen overall resilience by addressing supply chain weaknesses

Independent, In-Depth, Actionable

Unlike automated tools that generate generic risk ratings, Drawbridge assessments combine hands-on evaluation with industry-specific expertise. We examine your vendors’ cyber posture, assign severity and impact ratings, and deliver remediation guidance tailored to your firm’s risk profile.

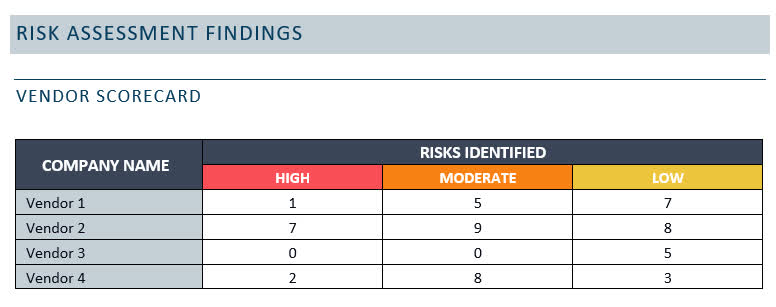

See your vendor landscape at a glance, with risks categorized by severity and impact.

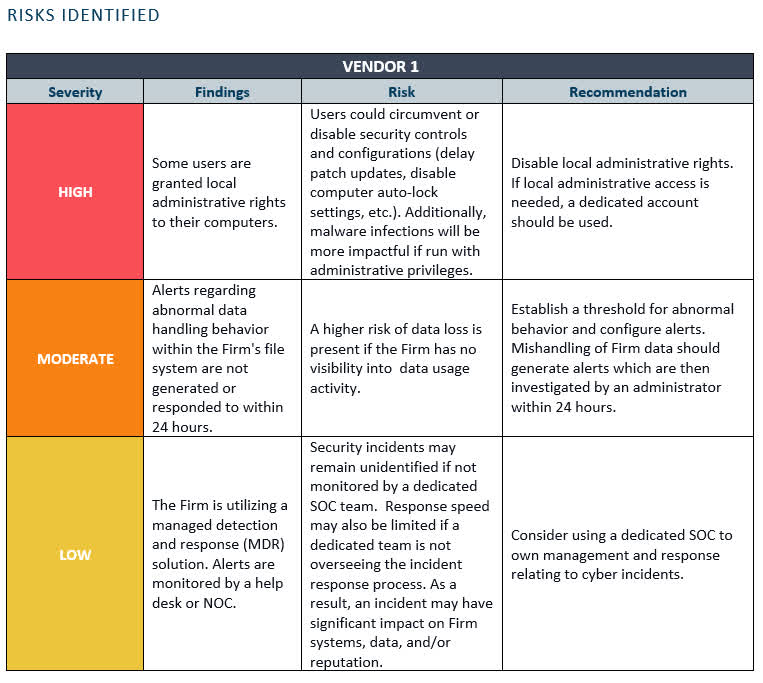

Qualitative findings with remediation guidance far beyond surface-level scores.

Proof of due diligence for regulators, investors and boards.

Why Firms Trust Drawbridge for Vendor Risk Oversight

Our vendor risk process is designed specifically for alternative investments firms, with independence and credibility built in.

Independent Assessments

No conflicts of interest, unlike MSP or vendor-led reviews

Alternatives Firms Specialization

Tailored for hedge funds, private equity, venture capital and RIAs

Qualitative Depth

Goes beyond generic scoring to provide real, actionable insight

Investor Recognition

Trusted by investors as part of due diligence reviews

Stronger Oversight, Greater Confidence

Trusted by 1,200+ firms to safeguard portfolios from third-party vulnerabilities.

Whether onboarding a new administrator, preparing for a regulatory exam or strengthening governance, Drawbridge helps firms identify and address supply chain risks before they become fund risks.