See How You Measure Up

Investors and regulators want proof that your cyber program is strong compared to your peers. Drawbridge Peer Benchmarking gives you that proof – showing exactly how your firm stacks up against 1,200+ alternative investment firms.

Where You Stand Matters

Your cyber maturity is judged against the market, whether you realize it or not. Investors compare managers. Regulators compare compliance levels. Without benchmarking, you’re flying blind.

Drawbridge Peer Benchmarking helps you:

See where your controls rank compared to similar firms

Identify gaps that could raise red flags in ODD

Highlight strengths that boost investor confidence

Track continuous improvement against industry standards

Benchmarking Built on the Industry’s Deepest Dataset

Drawbridge leverages proprietary data from thousands of assessments across the alternative investment ecosystem. The result: an unparalleled benchmarking tool that measures your cyber readiness with accuracy and context.

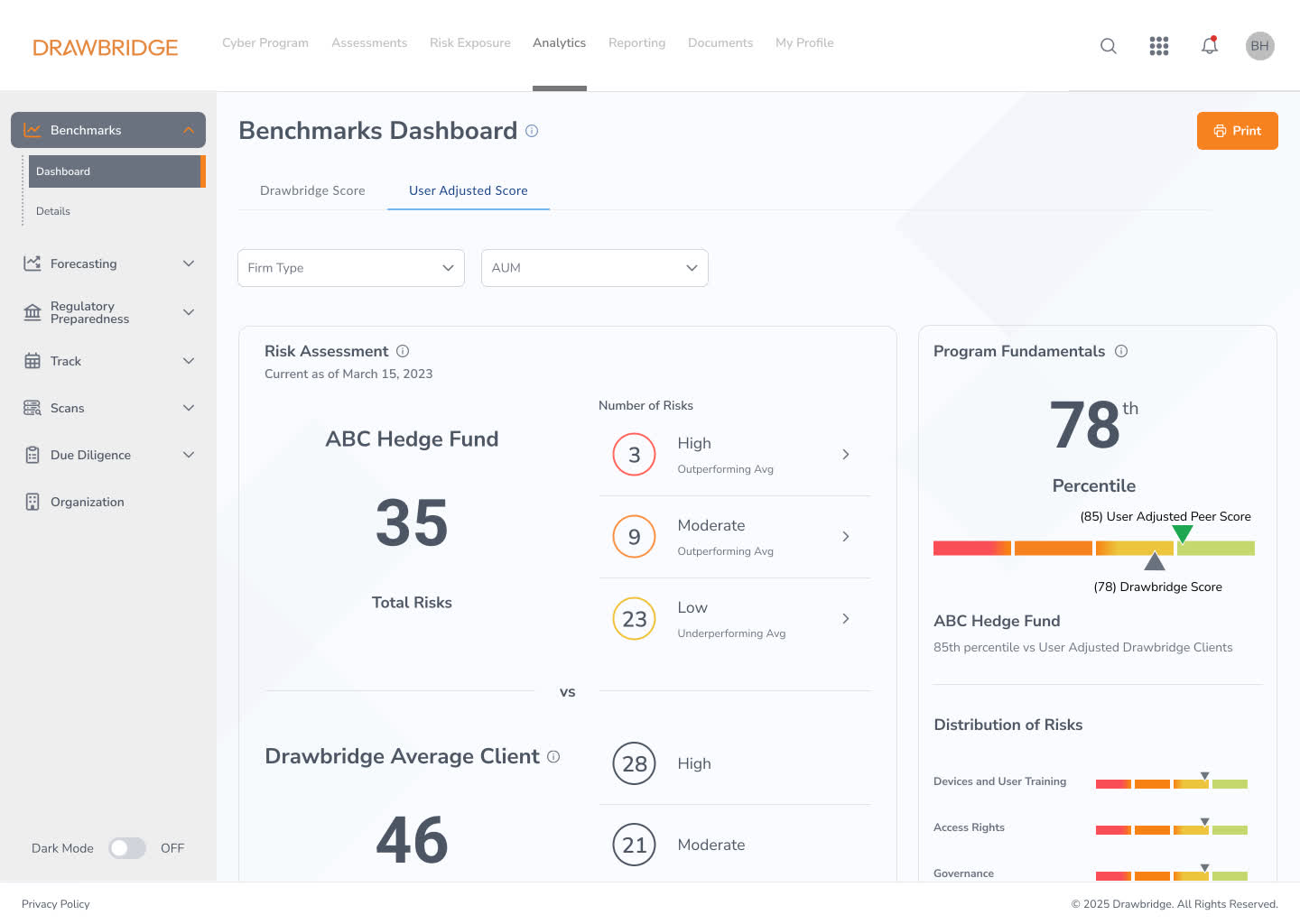

Instantly compare your cyber posture against peer groups — by fund size, strategy or geography.

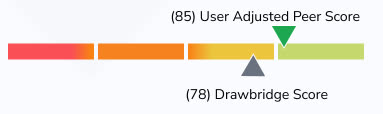

Your firm’s cyber score displayed against the industry median and top quartile benchmarks.

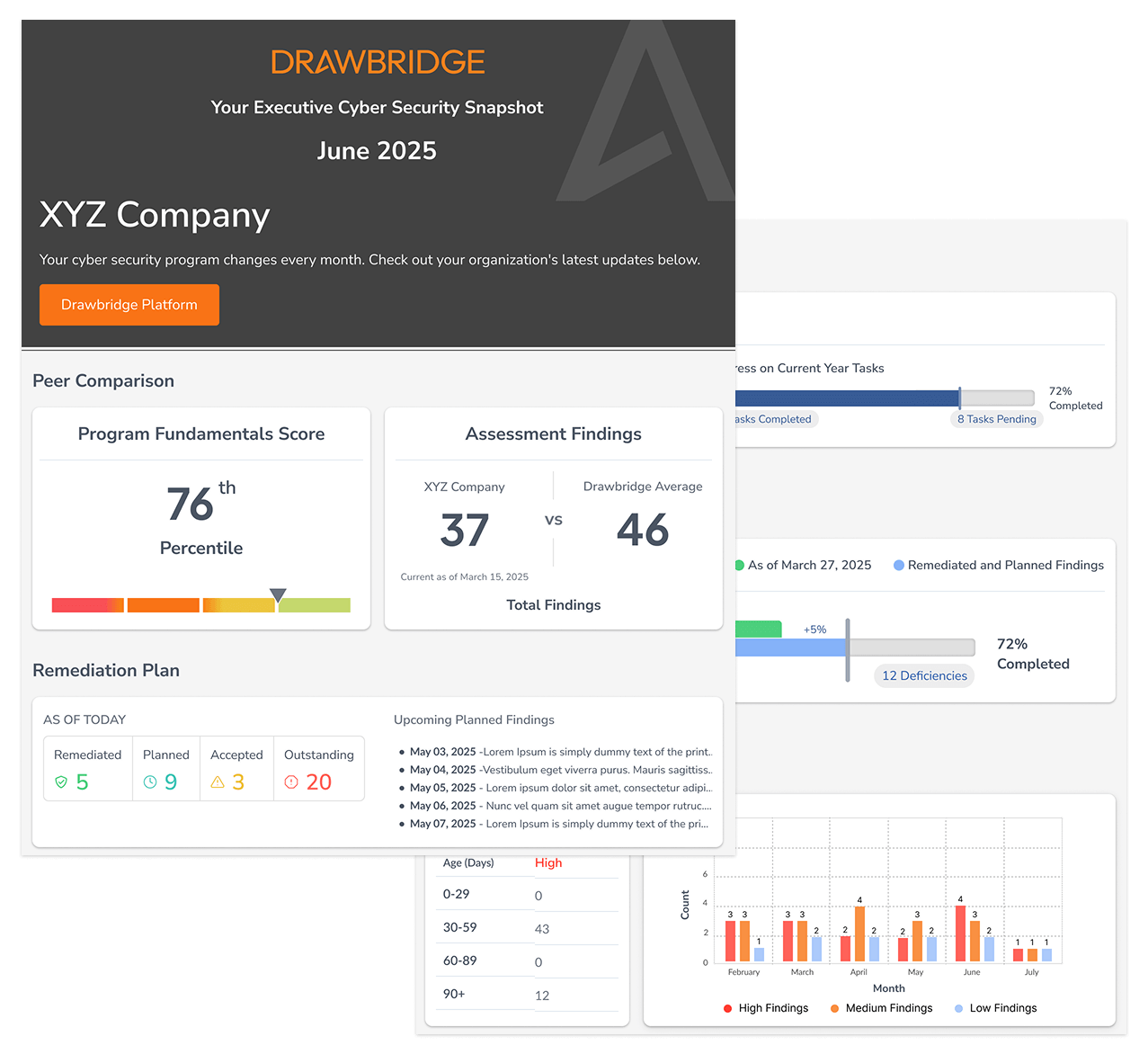

Track your improvements over time and show stakeholders measurable progress.

Board and investor-ready views for ODD reviews and fundraising discussions.

Why Firms Choose Drawbridge for Benchmarking

Unlike generic tools, Drawbridge Peer Benchmarking is built exclusively for alternative investments – and it shows.

Industry-Specific Data

Benchmark against 1,200+ hedge funds, private equity firms, RIAs and Investors.

Investor Recognition

Drawbridge benchmarking is trusted and respected across due diligence teams.

Data-Driven Accuracy

Proprietary algorithms powered by the industry’s deepest dataset.

Actionable Insight

Benchmark results link directly to remediation planning in the platform.

Benchmarking That Investors Trust

Trusted in 2,000+ ODD reviews and regulatory exams.

Drawbridge is the only platform where cyber benchmarking is recognized across Investors, investors and regulators. Over 1,200 firms and $1.7T+ AUM depend on Drawbridge for benchmarking clarity.